Every year, Americans spend over $640 billion on prescription drugs. But here’s the surprising part: generic drugs make up 91.5% of all prescriptions filled - yet they account for only 22% of total drug spending. That’s not magic. It’s insurance benefit design at work.

How Insurers Built a System to Push Generics

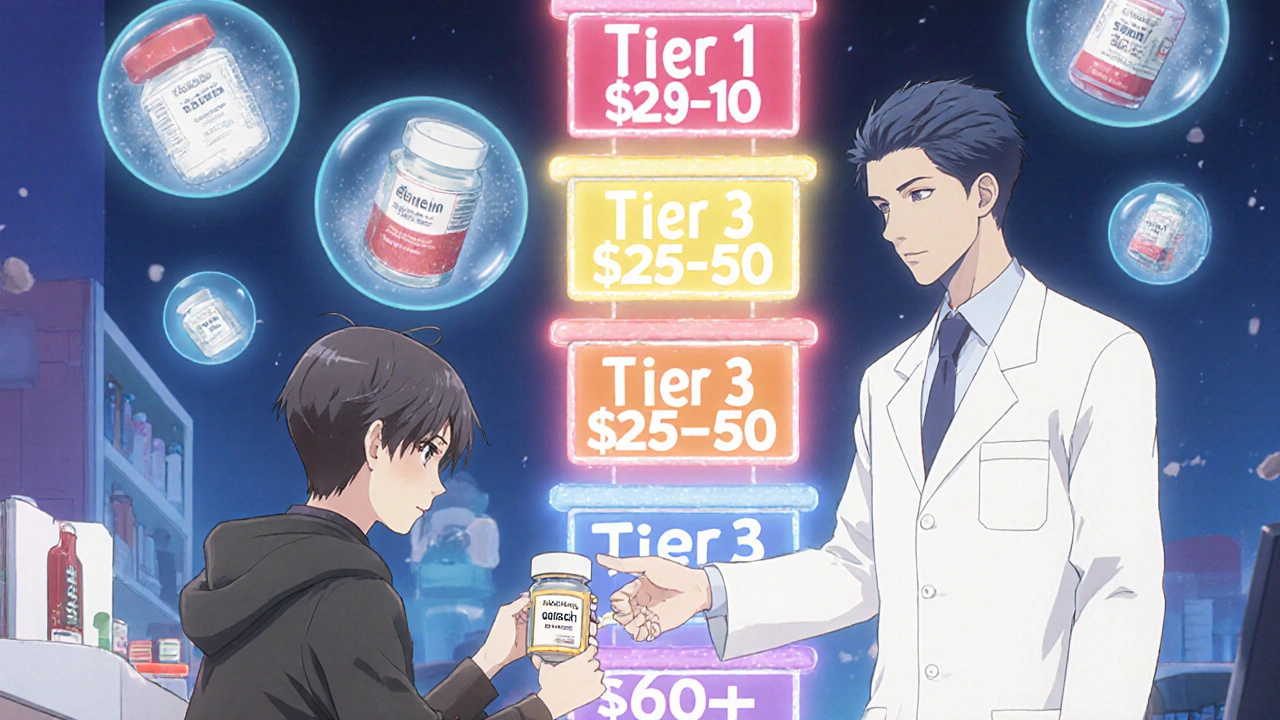

In the 1980s, after the Hatch-Waxman Act made it easier to approve generic versions of brand-name drugs, health plans didn’t just sit back and wait for savings to happen. They built systems to force the issue. The goal? Get patients to choose cheaper alternatives without sacrificing health outcomes. Today, nearly every commercial health plan, Medicare Part D plan, and Medicaid program uses a tiered formulary. Think of it like a pricing ladder. At the bottom is Tier 1: generics. These usually cost $0 to $10 for a 30-day supply. Move up to Tier 2 - preferred brand-name drugs - and you’re looking at $25 to $50. Tier 3? Non-preferred brands. That’s where you pay $60 to $100 or more. The math is simple: if your copay for a generic is $5 and the brand is $50, most people will pick the generic - even if they don’t know the difference. But it’s not just about price tags. Plans also use mandatory substitution rules. In 49 states, pharmacists can swap a brand-name drug for its generic equivalent without asking your doctor - as long as it’s FDA-approved and therapeutically equivalent. That’s not optional. It’s built into the contract between the pharmacy and the PBM (pharmacy benefit manager).Step Therapy and Closed Formularies: The Hidden Levers

Here’s where it gets more aggressive. Many plans use step therapy: you have to try the generic first. If it doesn’t work, then - and only then - can you get the brand. As of 2023, 92% of Medicare Part D plans require this. It’s not just a suggestion. It’s a rule. Some plans go even further with closed formularies. These exclude brand-name drugs entirely when a generic exists. One Medicare HMO studied in Health Affairs saw a 28.7% drop in brand-name use after switching to a closed formulary. No complaints. No exceptions. Just savings. And it works. From 2013 to 2022, generic drugs saved the U.S. healthcare system $3.7 trillion. That’s $370 billion a year. The average generic costs 80-85% less than the brand. For a drug like lisinopril (a common blood pressure pill), the brand version might cost $120 a month. The generic? $4.Who’s Really Saving Money? The PBM Problem

Here’s the catch: the savings aren’t always reaching you. Pharmacy benefit managers - CVS Caremark, OptumRx, Express Scripts - control how much pharmacies get paid and how much insurers pay. They negotiate rebates from drugmakers, but they don’t always pass those savings on. Instead, they use a practice called spread pricing. They tell your insurer they paid $5 for a generic. They tell the pharmacy they’ll pay $12. The $7 difference? That’s their profit. You still pay your $10 copay. The plan thinks it saved money. You think you’re paying fair price. But the real savings? Stuck in the middle. A 2022 USC Schaeffer Center study found patients were overpaying by $10-$15 per generic prescription because of this. Even worse, some plans use copay clawbacks. You pay $10 for your generic. The pharmacy gets reimbursed $12. But your plan says, “Wait - you only owe $5.” So they take back $5 from the pharmacy. That pharmacy? They’re forced to charge you $15 instead. You end up paying more than you should.

Medicare, Medicaid, and Employer Plans - All Different Rules

Medicare Part D plans cover 50 million seniors. They all have to use tiered formularies. But copays vary wildly. One plan might charge $0 for generics. Another charges $15. The difference? It’s not about quality. It’s about how aggressively the plan negotiates with PBMs. Medicaid is even more aggressive. Federal rules cap how much states can pay for generics - no more than 250% of the average manufacturer price. In 2022, Medicaid achieved an 89.3% generic dispensing rate - higher than commercial insurance. And they saved $1.2 billion that year. Employers? They’re the quiet powerhouses. Self-insured companies - like large tech firms or universities - often hire PBMs directly. A Johns Hopkins study found two big employers saved 9-15% on drug costs just by switching to generics. No drop in effectiveness. No increase in ER visits. Just lower bills.What Patients Actually Experience

On Reddit, a thread titled “Generic copay went from $5 to $0 last month - anyone else?” had 142 comments. Eighty-seven percent said, “Yes, and I’m thrilled.” One person wrote: “I take metformin. Used to pay $45. Now it’s free. I can finally afford my insulin too.” But others aren’t so lucky. A Kaiser Family Foundation survey found 22% of Medicare beneficiaries had trouble getting their doctor to approve a brand drug when a generic was required. Fourteen percent said their doctor had to appeal multiple times. One woman wrote: “I was switched from my brand-name seizure med to a generic. I had three seizures in two weeks. Took six months to get back on the brand.” And then there’s the confusion. Only 38% of Medicare beneficiaries understood their plan’s generic coverage in 2023. They think “$0 copay” means the drug is free. But if the plan doesn’t cover it at all - or if the pharmacy doesn’t stock it - they’re stuck paying full price. No warning. No explanation.

The New Players: Direct-to-Consumer and Transparency

Enter Mark Cuban Cost Plus Drug Company. Launched in 2022, it cuts out the PBM entirely. You buy generics directly. No insurance needed. Prices are transparent: cost of the drug + $3 + 15% markup. For some drugs, you save $5-$10 per prescription. For others, you save $50. It’s not for everyone. Medicaid patients get no savings. But for the uninsured, or those with high-deductible plans, it’s a game-changer. In 2023, MCCPDC offered 124 generic drugs - 26% of the most expensive ones. Starting January 1, 2025, insurers must show you exactly how much of your copay went to the pharmacy, how much went to the PBM, and how much was rebated. No more mystery. No more hidden spreads.What’s Next? The GENEROUS Model and Price Negotiation

In 2026, CMS is launching the GENEROUS Model - a new Medicaid program that lets the government negotiate generic drug prices directly with manufacturers. States will have to use standardized coverage rules. The goal? Cut $40 billion in Medicaid spending over ten years. Meanwhile, Medicare is starting to negotiate prices for the first time. The first 10 drugs under negotiation - including insulin and blood thinners - will see lower prices in 2026. The Congressional Budget Office estimates this will cut Part D premiums by 2.4% annually through 2032. But the biggest change? The $2,000 out-of-pocket cap for Medicare Part D, effective January 2025. Once you hit that cap, your drugs are free for the rest of the year. That changes the game. Why stick with a $100 brand when you can get the generic for $0? Now, the incentive isn’t just cost - it’s convenience.Bottom Line: Generics Work - But the System Is Broken

Generic drugs are one of the most effective cost-control tools in healthcare. They’re safe. They’re effective. And they’re cheap. But the system designed to deliver those savings? It’s full of middlemen, hidden fees, and confusing rules. Patients are saving money - but not always. PBMs are profiting - sometimes at the patient’s expense. And without transparency, the savings stay buried. The future isn’t about banning generics. It’s about fixing the pipeline. Clearer pricing. Fairer rebates. Fewer barriers. And real savings - not just on paper, but in your wallet.Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also prove they’re bioequivalent - meaning they work the same way in your body. Over 90% of prescriptions filled in the U.S. are generics, and studies show they perform just as well in real-world use.

Why does my generic drug cost more than expected?

You might be paying more due to spread pricing by your pharmacy benefit manager (PBM). The PBM tells your insurer they paid $5 for the drug, but pays the pharmacy only $8. You pay your $10 copay. The $2 difference goes to the PBM, not you. Some plans also use copay clawbacks, where the pharmacy gets reimbursed more than your copay - then the plan takes money back from the pharmacy, forcing them to charge you more.

Can my pharmacist switch my brand-name drug to a generic without asking my doctor?

In 49 states, yes - if the generic is FDA-approved and therapeutically equivalent. The only exception is if your doctor writes “dispense as written” on the prescription. Even then, your insurance plan may still require you to try the generic first before covering the brand.

What’s the difference between a tiered formulary and a closed formulary?

A tiered formulary puts generics in the lowest-cost tier (Tier 1) and brand-name drugs in higher tiers with higher copays. A closed formulary doesn’t allow brand-name drugs at all if a generic exists - you’re only covered for the generic. Closed formularies save more money but offer less flexibility.

Why do some people have bad reactions after switching to generics?

While rare, some patients report differences in side effects or effectiveness after switching. This can happen with drugs that have a narrow therapeutic index - like seizure medications, thyroid hormones, or blood thinners. The inactive ingredients (fillers, dyes) in generics can vary, and a small number of people are sensitive to them. If you feel worse after a switch, tell your doctor - you may qualify for a brand-name exception.

Should I use Mark Cuban’s Cost Plus Drug Company instead of my insurance?

It depends. If you’re uninsured or have a high-deductible plan, you can save 10-50% on some generics by buying directly. But if you’re on Medicaid or Medicare, you won’t save anything - and you’ll lose the benefit of your plan’s negotiated rates. Check prices on both. For common generics like metformin or atorvastatin, the direct option often wins. For specialty drugs, stick with your plan.

Will the new Medicare drug price negotiations affect generic drugs?

No. The Inflation Reduction Act’s price negotiation rules apply only to a small number of brand-name drugs with no generic competition. Generics are already cheap and competitive, so they’re not part of the negotiation. But the new $2,000 out-of-pocket cap for Medicare Part D (starting 2025) will make generics even more attractive - because once you hit the cap, you get them for free.

8 Responses

So let me get this straight - we’ve got a system where generics save $370 billion a year, but the middlemen are pocketing the difference like it’s a damn casino? And we’re supposed to be grateful because our copay dropped from $45 to $5? Bro. I’d be throwing a parade if my rent dropped that much. But this isn’t charity. It’s a rigged game where the house always wins - and we’re the suckers holding the tickets.

Generics are a great step toward affordable healthcare. In India, we have seen how generic medicines bring life-saving drugs to millions. The system may have flaws, but the core idea - saving money without sacrificing health - is noble. We must ensure transparency so that everyone, rich or poor, benefits equally.

Let’s be precise: generics are not just ‘cheaper’ - they are bioequivalent, FDA-regulated, and clinically proven to be therapeutically indistinguishable from brand-name drugs in over 90% of cases. The real issue isn’t efficacy - it’s structural corruption in the PBM ecosystem. Spread pricing, clawbacks, and opaque rebate structures are not bugs; they’re features of a broken incentive model. Fix the middlemen, not the medicine.

Y’all act like PBMs are some kind of evil empire - and yeah, they are. But here’s the truth: if you’re on Medicare or Medicaid, you’re already getting the cheapest possible version because the government forced it. The only people getting screwed are those with private insurance who think they’re ‘saving’ money while their PBM quietly takes $7 per script. And don’t even get me started on how pharmacies get squeezed until they charge you $15 just to break even. This isn’t healthcare - it’s financial warfare, and we’re the front line.

I’ve been taking levothyroxine for years. My doctor switched me to generic - and I felt fine. But I read everything I could find. I asked my pharmacist about fillers. I checked if my thyroid levels stayed stable. I didn’t just accept it. I investigated. And that’s what we all need to do - not just trust, but verify. Knowledge is the only real protection we have against a system that doesn’t always have our backs.

Think about it. The same companies that run your pharmacy benefit managers also own major news outlets, lobby Congress, and quietly fund political campaigns. They invented the term ‘formulary’ to confuse you. They designed tiered pricing so you’d think you’re making a smart choice when you’re just being nudged toward profit. And now they’re pushing this ‘transparency’ thing like it’s a gift - when it’s just damage control after a decade of ripping off seniors, diabetics, and single moms. This isn’t capitalism. It’s a corporate oligarchy wearing a white coat.

Man, I love how this post breaks it all down - like a good Irish pub chat with a pharmacist who actually knows what’s going on. PBMs are the silent villains here, aren’t they? Like that guy at the corner shop who says ‘I’ll get you a deal’ and then pockets the change. And Mark Cuban’s thing? Brilliant. Cut out the middleman, give folks the truth, and let them choose. Simple. Clean. No jargon. Just price + markup. Why can’t the whole system be like that?

Just got my metformin for $0 this month. No joke. I used to pay $40. Now I can afford my insulin. This isn’t politics - it’s survival. The system’s broken, but generics? They’re the one thing that actually works. Just make sure your pharmacy stocks them - and don’t trust the ‘$0 copay’ label if your plan doesn’t cover it. Read the fine print. Always.