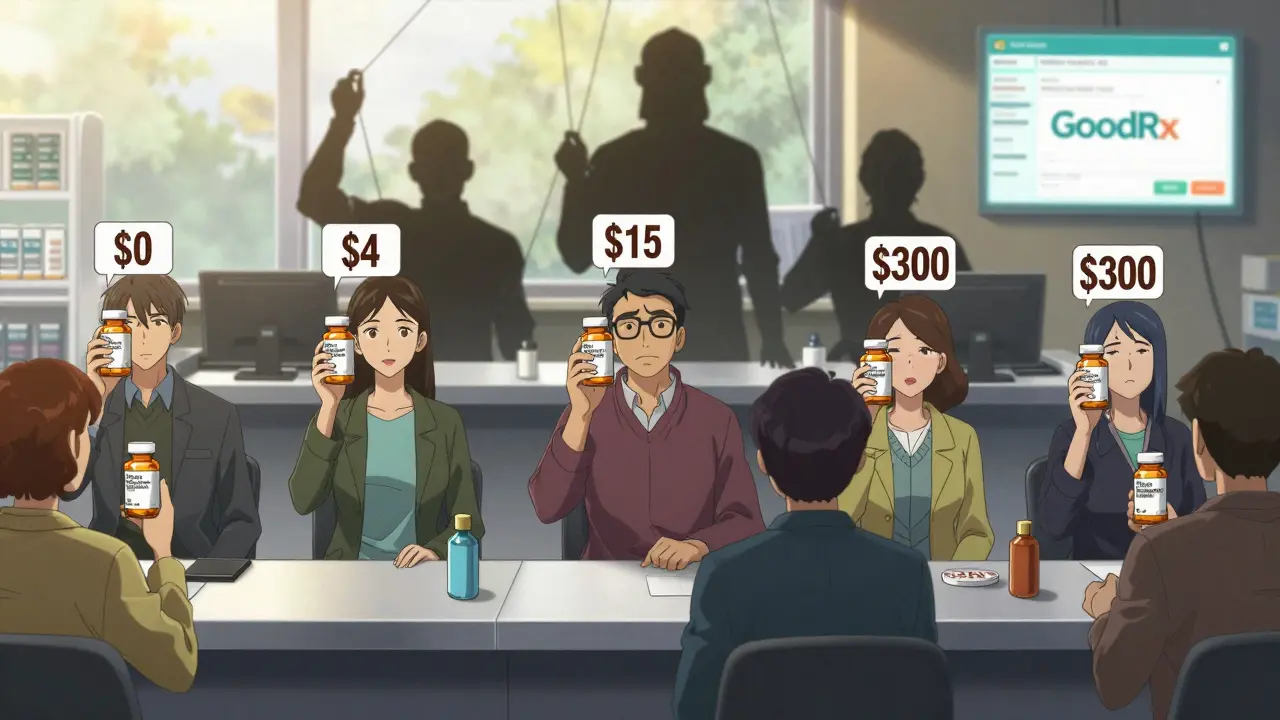

When you walk into a pharmacy to pick up your monthly prescription, you might assume the price is fixed - set by the drugmaker, the insurer, or the government. But in reality, the price you pay for a generic drug can vary wildly - from $0 to $300 - depending on a hidden battle happening behind the scenes. This is the generic price war, and it’s one of the most powerful forces shaping what you pay for medicine in the U.S.

How Generic Price Wars Actually Work

Generic drugs are copies of brand-name medications that become available after the original patent expires. They contain the same active ingredients, work the same way, and are held to the same safety standards. But they cost far less - sometimes less than 10% of the brand-name price. The reason? Competition. When multiple companies start making the same generic drug, they fight for market share by lowering prices. The more competitors, the harder they push. According to the FDA, when six or more companies make the same generic drug, prices drop more than 95% compared to the original brand. That’s not a guess - it’s data from real prescriptions. Here’s how it breaks down by number of competitors:- One generic maker: 15-30% cheaper than brand

- Two generic makers: 44-54% cheaper

- Four generic makers: 73-79% cheaper

- Six or more generic makers: over 95% cheaper

Why You Might Still Be Paying Too Much

Even with dozens of generic makers, you might still be overpaying. Why? Because the price you see at the register isn’t always the real price. Pharmacy Benefit Managers (PBMs) - middlemen hired by insurers and employers - control most of the drug pricing system. They negotiate discounts with drugmakers and pharmacies, but they don’t always pass those savings to you. Instead, they use practices like:- Spread pricing: They tell your insurer they paid $2 for a pill, but charge you $15. The $13 difference goes to them.

- Copay clawbacks: You pay a $5 copay, but the pharmacy only gets $2 from the PBM. So the pharmacy charges you $5 anyway - even if the cash price is $1.

- Formulary bias: PBMs push you toward more expensive generics (or even brand drugs) because they get bigger rebates.

The Real Winners - and Losers - in This System

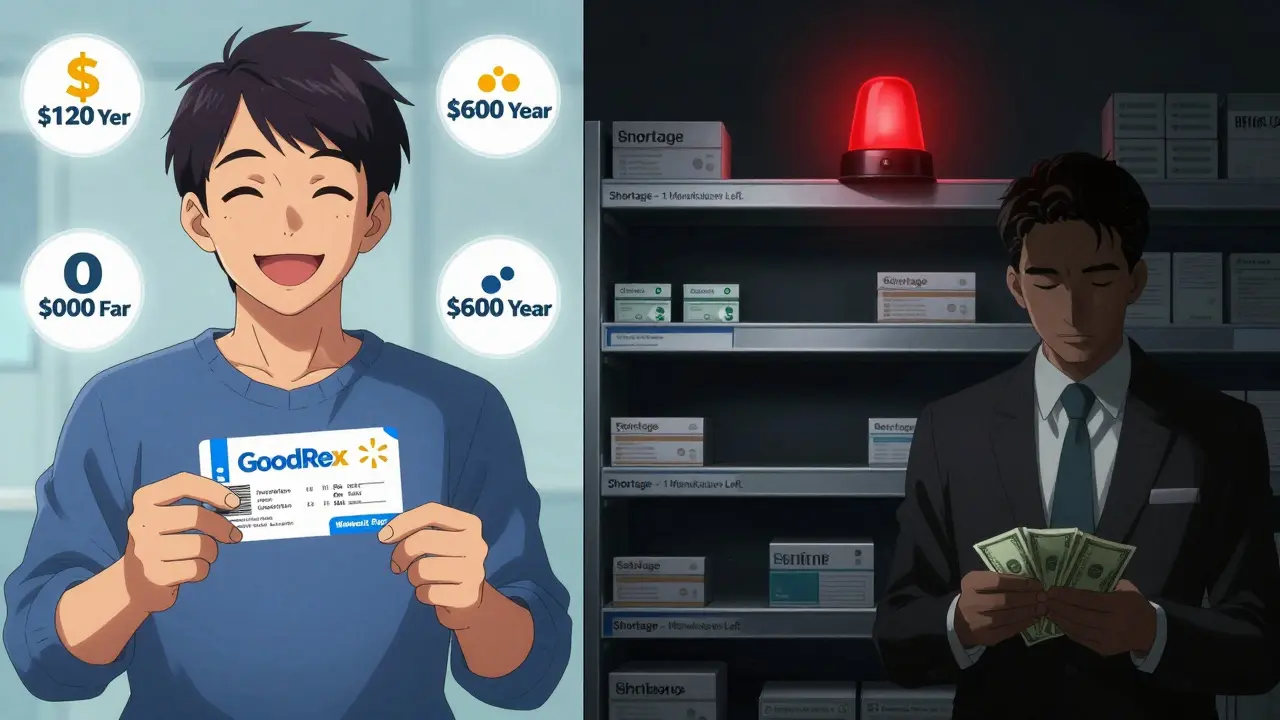

Who benefits the most from generic price wars? It’s not always the patient. Pharmacies make 42.7% gross margins on generics, compared to just 3.5% on brand-name drugs. That’s why they push generics - they make more money off them. But that doesn’t mean you’re getting the savings. The biggest winners are insurers and PBMs. A 2020 analysis from the Assistant Secretary for Planning and Evaluation (ASPE) found Medicare could have saved nearly $1 billion in 2016 alone if pharmacists had substituted cheaper generic combinations. Instead, patients paid more, and intermediaries kept the difference. And then there’s the flip side: when prices drop too low, manufacturers quit. That’s what happened with antibiotics, heart medications, and even epinephrine auto-injectors. When only one or two companies are left making a generic, prices spike again. In 2024, 30% of drug shortages occurred in markets that once had four or more competitors. The race to the bottom can leave patients without medicine altogether.How to Actually Save Money - Step by Step

You can’t control how many companies make your drug. But you can control what you pay. Here’s how:- Always ask for the cash price. Don’t assume your insurance copay is the lowest. In 28% of cases, paying out-of-pocket is cheaper - even if you have insurance.

- Compare prices across pharmacies. The same generic drug can cost $5 at CVS, $12 at Walgreens, and $0 at Walmart. Use GoodRx or SingleCare to check prices before you go.

- Check the therapeutic equivalence code. Look for “AB” on the label. That means it’s bioequivalent to the brand. Avoid “BX” drugs - they’re not proven to work the same.

- Focus on chronic meds. Small savings on monthly pills add up fast. Saving $10 a month on blood pressure meds = $120 a year. Do that for five drugs? That’s $600.

- Don’t trust “brand loyalty” coupons. If your doctor gives you a coupon for the expensive brand, it’s usually because the PBM paid them to. The generic is just as effective.

What’s Changing - And What’s Not

The government is starting to step in. The 2022 Inflation Reduction Act lets Medicare negotiate prices for some drugs. The 2023 Pharmacy Benefit Manager Transparency Act would force PBMs to pass savings directly to patients. The FDA approved over 1,000 generic drugs in 2023 - up from 748 the year before - which should boost competition. But the system is still broken. Five companies - Teva, Viatris, Sandoz, Amneal, and Aurobindo - control over 60% of the U.S. generic market. That’s not competition. That’s an oligopoly. And when competition is limited, prices stay high. The bottom line? Generic price wars exist. But they don’t always reach you. The savings are real - if you know how to find them.What You Can Do Today

Next time you fill a prescription, take five minutes. Open the GoodRx app. Type in your drug name. Look at the cash price. Ask your pharmacist: “Is this the lowest price I can pay?” You might be shocked. You might save $50. Or $200. Or nothing - because your drug has no competition yet. But at least you’ll know why. This isn’t about blaming pharmacies or doctors. It’s about understanding a system designed to hide savings. And once you know how it works, you can take back control.Why are generic drugs sometimes more expensive than brand-name drugs?

Generic drugs are almost always cheaper, but not always. If only one or two companies make a generic, there’s little competition - so prices stay high. Some generics are priced near the brand because manufacturers haven’t entered the market yet, or they’ve left due to low profits. Always check the cash price - it’s often lower than your insurance copay.

Can I trust that generic drugs work the same as brand-name ones?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage form, and absorption rate as the brand. Look for the “AB” rating on the label - that means it’s approved as bioequivalent. Only avoid “BX” rated drugs, which haven’t been proven to work the same way.

Why does my insurance copay change every month for the same generic drug?

Your insurance plan’s formulary - the list of covered drugs - changes often. PBMs may swap out cheaper generics for more expensive ones if they get a bigger rebate. Also, if a manufacturer raises its price or leaves the market, your plan may switch to a different generic - and your copay could go up. Always check your pharmacy receipt and compare prices.

Are there generic versions of all brand-name drugs?

No. Only drugs whose patents have expired can have generics. Some newer drugs - especially biologics like insulin or Humira - don’t have true generics yet. Instead, they have “biosimilars,” which are similar but not identical. These are often more expensive and have fewer competitors, so savings are smaller.

Why do some pharmacies offer $4 generics while others charge $50?

Discount programs like Walmart’s $4 list are cash-only deals. They’re not tied to insurance. These pharmacies make up the difference by selling other products or attracting more customers. Insurance-based pricing includes hidden fees from PBMs, which can inflate the cost. Always ask: “What’s the cash price?” - even if you have insurance.

What should I do if my generic drug suddenly disappears or gets much more expensive?

It’s likely due to a shortage caused by low prices driving manufacturers out of the market. Ask your pharmacist for alternatives - there may be another generic version available. You can also check the FDA’s Drug Shortages database. If it’s a critical medication, contact your doctor immediately. In the meantime, use GoodRx to find the best available price across nearby pharmacies.

14 Responses

PBMs are the real villains here. They're not middlemen, they're parasites. They suck the life out of the system and laugh while you pay $15 for a $1 pill. The FDA? They're asleep at the wheel. This isn't capitalism, it's feudalism with a pharmacy counter.

This is such an important post! Many people in India face similar issues but without the tools like GoodRx. Even small savings on monthly meds can change lives. Keep sharing these truths - awareness is the first step to change.

You're being too soft. This isn't about 'saving money' - it's about systemic theft. Pharmacies, PBMs, insurers - they're all in on the scam. The fact that you have to hunt down the truth like a detective means the system is designed to fail you. Stop asking nicely. Start demanding justice.

I used to pay $45 for my blood pressure med until I found out the cash price was $3 at Walmart. Mind blown. Now I always check GoodRx first. It's not rocket science - just common sense. Why do we make it so hard?

Ah yes... the American healthcare circus. In India, we get generics for pennies - because the government doesn't let greedy middlemen rip us off. Here? You need a PhD in pharmacy law just to buy aspirin. And you wonder why people don't trust the system...

This is a textbook case of regulatory capture. The FDA approves generics, but the PBM lobby controls formularies. The Inflation Reduction Act? A distraction. They'll let Medicare negotiate 10 drugs while ignoring the 10,000 others that are still being gouged. This isn't reform - it's theater.

The structural inequities embedded within pharmaceutical distribution networks are both profound and systematically obscured. Patients are rendered passive consumers within a value chain that prioritizes intermediary profit over therapeutic accessibility. The moral imperative to demand transparency is not merely pragmatic - it is ethical.

You say competition drives prices down. But what if the competition is fake? What if five companies are owned by the same hedge fund? What if Teva and Viatris are just two faces of the same monster? The FDA calls it 'competition' - but it's collusion with better PR.

I used to panic when my copay changed. Then I learned to ask for the cash price. It’s not magic - it’s power. You don’t need a degree to fight this. You just need to ask. And if they say no? Walk out. There’s always another pharmacy.

People think they're saving by using insurance. They're not. They're paying for the privilege of being exploited. The system rewards ignorance. If you're still trusting your pharmacist to tell you the truth, you're already losing.

I used to feel guilty for switching pharmacies. Now I don't. If a store won't tell me the cash price, they don't deserve my business. It's not rude - it's responsible. And saving $120 a year on meds? That's not a win. That's survival.

Back home in Delhi, my uncle buys his diabetes meds for $2 a month. No coupons. No apps. Just a local chemist who knows his name. Here, we need algorithms and barcodes just to buy a pill. We traded community for complexity - and lost both.

I didn't know any of this until my mom got hit with a $75 bill for metformin. We checked GoodRx - $3. I cried. Not because it was cheap, but because we paid $72 too much for three years. I wish someone had told us sooner. Don't wait for a crisis. Check your next script.

This is why I always ask the pharmacist: 'Is there a cheaper way?' They usually sigh and say 'yeah, but...' and then tell me. It's not their fault. They're stuck in the machine too. But if you don't ask, they can't help.